The Importance of Financial Literacy in Personal Financial Management

There’s a saying that goes: “It’s not how much you earn, it’s how much you keep.”

And at the core of that truth lies financial literacy—a skill set that’s as important as reading or writing in today’s fast-paced world.

We live in a time where credit cards are handed out like candy, buy-now-pay-later services are a click away, and financial jargon flies over our heads like birds in the sky. And yet, most of us were never taught how to manage money, build wealth, or avoid debt traps.

This is where financial literacy enters the scene—not just as a concept, but as a life-changing practice.

At junkybooks, we believe knowledge is power, and when it comes to money, the right knowledge can change your entire future. Whether you're just starting your career, navigating mid-life responsibilities, or planning for retirement, understanding the basics of personal financial management can make all the difference.

Let’s dive into what financial literacy means, why it matters, and how you can build your financial toolkit one step at a time.

What Is Financial Literacy?

Financial literacy is the ability to understand and effectively use financial skills like budgeting, saving, investing, and debt management. It’s knowing how to read a credit report, what compound interest means, and why you shouldn’t spend more than you earn.

In simpler terms, it’s having the financial common sense that helps you make smarter decisions with your money.

When you’re financially literate, you don’t just react—you plan. You don’t guess—you calculate. You’re not overwhelmed by money—you control it.

Why Financial Literacy Matters More Than Ever

Let me tell you a story.

A few years ago, a close friend of mine got his first job after university. It paid well. Like most people, he started spending freely—new phone, designer clothes, daily takeout. He didn’t track expenses or save a dime. Within six months, he was knee-deep in credit card debt and couldn’t cover an emergency car repair.

What went wrong? He wasn’t lazy or irresponsible. He just didn’t know.

This is the story of millions around the world—intelligent, hardworking people falling into financial trouble simply because they were never taught how to handle money.

The Five Pillars of Financial Literacy

Let’s break down the key areas every financially literate person should understand:

1. Budgeting

Budgeting is the foundation of financial control. It helps you track income and expenses, prioritize spending, and avoid overspending.

There are many methods—from the 50/30/20 rule to zero-based budgeting—but the goal is always the same: Know where your money is going.

2. Saving

A good savings habit is your safety net. Whether it’s for emergencies, a vacation, or a home down payment, saving regularly builds financial security.

Understanding interest rates, inflation, and the value of compound interest is crucial here.

3. Debt Management

Not all debt is bad, but unmanaged debt is dangerous. Financial literacy helps you understand the cost of borrowing, how to reduce high-interest debts, and how to use credit responsibly.

4. Investing

Once you’ve saved, you can start to grow your money. This means learning about stocks, mutual funds, bonds, real estate, and retirement accounts.

Investing literacy is essential for building long-term wealth and achieving financial freedom.

5. Financial Planning

This includes setting short- and long-term financial goals, understanding insurance, planning for retirement, and estate planning.

Financial planning ensures that your future is as secure as your present.

Financial Literacy and Personal Empowerment

There’s something deeply empowering about understanding money.

You begin to see your paycheck not just as something to spend, but something to grow. You stop fearing bills, and start anticipating them. You begin to take charge.

Financial literacy reduces stress. It helps relationships (money fights are one of the top causes of breakups and divorce). It gives you the confidence to make big decisions—buying a house, changing careers, or starting a business—because you know how to plan for them.

Common Myths That Keep People Financially Illiterate

Let’s bust a few myths that hold people back from learning about money:

“I’m not good with numbers.”

You don’t need to be a math genius to manage money. Most budgeting is basic addition and subtraction, and there are plenty of apps and tools to help.

“I don’t earn enough to need a budget.”

The less you earn, the more important budgeting becomes. It ensures every dollar works for you.

“Investing is too risky.”

Yes, there’s risk—but there’s also risk in doing nothing. Learning how to invest wisely can protect and grow your wealth over time.

“I’ll start saving when I earn more.”

The habit of saving is more important than the amount. Start with what you have—even if it’s just ₦1,000 a month. Build the muscle.

How to Improve Your Financial Literacy

Improving your financial knowledge doesn’t require a finance degree. All it takes is curiosity, consistency, and a willingness to learn.

Here are a few easy steps to begin your journey:

1. Read Financial Books and Blogs

Books like “Rich Dad Poor Dad”, “The Psychology of Money”, or “Your Money or Your Life” are a great place to start. Websites like junkybooks offer accessible content for beginners and seasoned readers alike.

2. Follow Financial Experts on Social Media

From TikTok to Instagram, there’s a growing community of financial educators who break down complex topics into digestible tips.

3. Use Financial Tools and Apps

Budgeting apps, investment platforms, and savings trackers make managing money easier and more interactive.

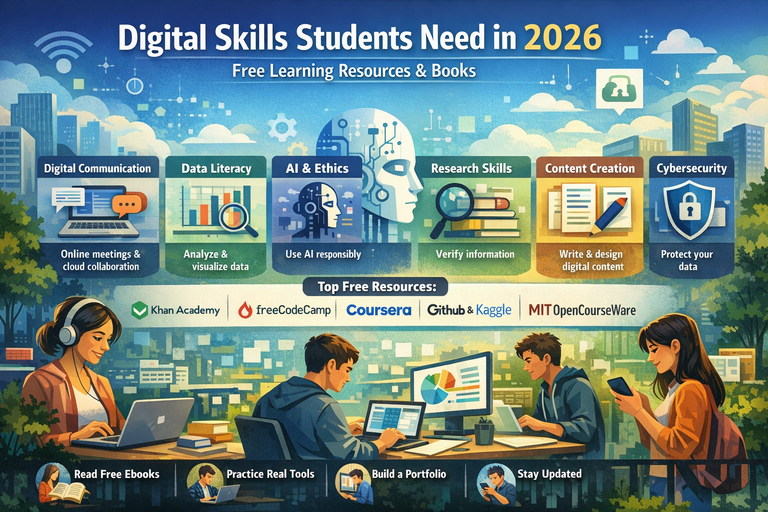

4. Take Online Courses

Many platforms offer free or affordable courses on personal finance—Coursera, Khan Academy, and YouTube are goldmines of knowledge.

5. Practice What You Learn

Apply lessons in real time. Create a budget, open a savings account, track your spending, or try a small investment.

Knowledge without action is just potential. When you apply what you learn, that’s when your finances start to transform.

Teaching Financial Literacy Early

Financial education should start young. Teaching kids and teenagers how to handle money is one of the greatest gifts we can give.

Simple lessons like earning through chores, saving part of their allowance, or understanding the difference between wants and needs lay the foundation for responsible adulthood.

As parents, mentors, or educators, we can normalize money conversations, model good financial behavior, and encourage financial curiosity from an early age.

Financial Literacy in the Digital Age

Digital tools have made financial literacy more accessible than ever—but they’ve also made managing money more tempting and risky.

With one click, you can take out a loan, buy crypto, or shop internationally. Without education, this convenience becomes a trap.

Financial literacy helps you use technology wisely—to compare prices, find better interest rates, automate savings, and track expenses. It empowers you to be the master of your digital wallet.

Financial Literacy and Financial Independence

Ultimately, the goal of financial literacy isn’t just to “manage money”—it’s to achieve financial independence. That’s the freedom to make life choices without being held back by money.

It’s the ability to take time off work without panic. To support your family. To retire comfortably. To say yes to opportunities and no to stress.

At junkybooks, we’ve seen readers go from paycheck-to-paycheck living to buying their first property, launching businesses, or funding their kids' education—all because they started learning about money.

A Final Word: Your Journey Starts Now

You don’t need to know everything right away. You just need to start.

Financial literacy is a lifelong journey, and every step you take adds up. Whether you’re learning how to budget, dipping your toes into investing, or simply avoiding debt traps, every bit of knowledge gets you closer to financial freedom.

And remember—you’re not alone. There are resources, communities, and tools like junkybooks dedicated to helping you grow smarter, stronger, and more confident with your money.

Start today. Your future self will thank you.