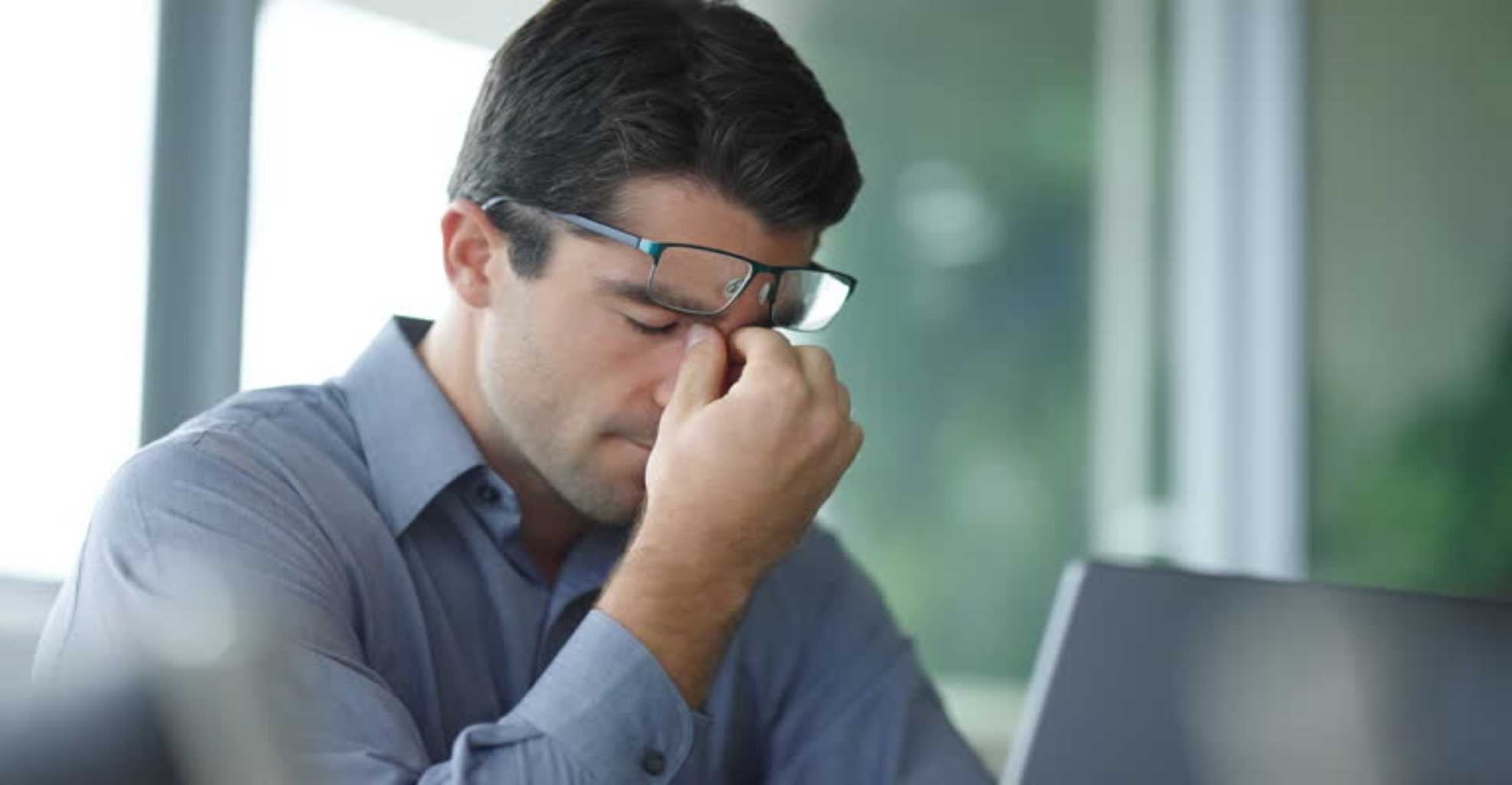

How Financial Stress Affects Mental Health

Introduction

Financial stress is an issue most individuals experience around the world. Either due to debt, job insecurity, or surprise bills, financial problems can have a drastic effect on mental well-being.

The anxiety and uncertainty that are part of financial stress can lead to depression, anxiety, and chronic stress. This article covers the impact of financial stress on mental health, the psychological and physiological effects, and effective ways to fight financial anxiety.

Understanding Financial Stress

Financial stress occurs when a person perceives that they do not have the financial means to fulfill their requirements. Financial stress may be caused by several factors, such as:

- Debt: Credit card debt, student loans, and mortgages can be recurring financial pressures.

- Job Loss or Instability: Fear of job loss can result in worry regarding future financial stability.

- Unexpected Expenses: Medical bills, car repair, or unexpected home repairs can lead to tremendous financial pressure.

- Rising Cost of Living: Recessions and inflation can cause strain on paying for basic necessities.

Whether caused by sickness, injury, or job loss, long-term financial stress can have severe effects on mental and emotional well-being.

The Psychological Effect of Financial Stress

1. Anxiety and Depression

Constant worry about money can result in chronic depression and anxiety. Individuals who are in financial trouble usually feel hopeless, worthless, and out of control. This may result in sleep disturbances, mood swings, and social withdrawal.

2. Cognitive Overload

Financial concerns take up much mental space, and it is difficult to focus on regular tasks. Such mental burden can lead to low productivity, decreased ability to make decisions, and ineffective problem-solving.

3. Stress on Relationships

Financial stress is one of the main causes of relationship failure. Couples will argue and quarrel over money issues, become resentful and eventually get separated or divorced. People may also feel inadequate and insecure under the pressure of providing for a family.

4. Low Self-Esteem and Shame

Most individuals feel a personal loss when there are money issues. Societal pressures to succeed in finance cause embarrassment and humiliation, hence no one feels comfortable seeking help or sharing the difficulties easily.

The Physical Effects of Financial Strain

Financial strain also does not occur in a vacuum - it has tangible physical effects among which are:

1. Chronic Stress and Cortisol Levels

Stress triggers the release of cortisol, the body's principal stress hormone. Ongoing money stress keeps cortisol levels elevated, leading to high blood pressure, impaired immune response, and heart disease risk.

2. Sleep Disturbances

Money worries can cause insomnia, nightmares, and fitful sleep. Lack of sleep also fuels further stress and perpetuates a cycle of worry and exhaustion.

3. Unhealthy Coping Mechanisms

People who are under financial stress can turn to bad coping mechanisms such as excessive eating, drug use, or overspending. All of these can worsen money and mental health conditions in the long run.

4. Increased Risk of Physical Illness

Stress has been linked with the enhanced risk of such conditions as headaches, gastrointestinal diseases, and chronic pain. Individuals under financial stress can also delay medical attention due to the expense, leading to untreated sicknesses.

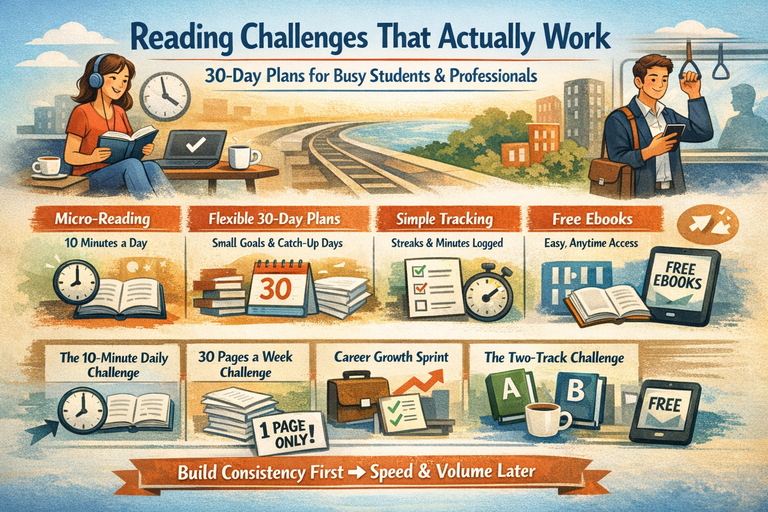

Coping with Financial Stress

Financial stress may appear to be crushing, but there are strategies to deal with its impact on mental health.

1. Create a Budget and Financial Plan

One of the most successful ways to reduce financial strain is to set a clear budget. Having an understanding of income, expenses, and savings goals can provide a sense of financial control. Budgeting software and apps can be used to track spending and set financial stability.

2. Seek Professional Help

Money assistance and counseling could be provided by financial planners, credit counselors, and mental health professionals. Taking professional advice would help one determine healthy financial plans and goals.

3. Implement Stress-Reducing Techniques

Mindfulness, meditation, and breathing can serve to reduce tension and enhance general health. Regular physical exercise in the form of yoga or walks may also work towards reducing tension.

4. Open Money Dialogue

Talking through money problems with a supportive spouse, friend, or therapist can help feel less isolated. Support groups and cyber support groups can also provide a source of sharing and learning from others in similar circumstances.

5. Set Realistic Financial Goals

Setting small, achievable financial goals can give a feeling of momentum and motivation forward. Breaking down major financial hurdles into smaller steps makes them less overwhelming.

6. Reduce Non-Necessity Expenditures

Reducing discretionary spending, such as dining out or subscription services, can free up funds for essential spending. Saving money by being creative, such as planning meals and discount shopping, can also stretch one's budget.

7. Increase Financial Savviness

Educating oneself on personal finance can dispel some confusion and establish self-assurance when dealing with money. Educating oneself through reading financial well-being books, online courses, or workshop attendance can enhance financial decision-making skills.

The Role of the Employer in Reducing Financial Stress

Organizations can play a significant role in helping employees with financial stress. Some effective examples are:

- Financial Wellness Programs: Providing exposure to budgeting and financial planning tools.

- Fair Compensation and Benefits: Offering workers fair pay, health coverage, and retirement plans.

- Flexible Work Arrangements: Offering telecommuting or flexible work schedules to reduce transportation costs.

- Mental Health Support: Providing employee assistance programs (EAPs) that offer counseling for financial and emotional well-being.

Conclusion

Financial stress is a primary cause of mental health problems, affecting emotions, relationships, and physical well-being. While financial challenges can be stressful, there are practical actions that can be taken to reduce stress and increase financial stability. Budgeting, professional advice, stress-reduction skills, and greater financial literacy all can result in a better attitude. Employers can also help support their employees' finances as well. By being proactive regarding financial stress, individuals can gain control of their mental health and work toward financial security and peace of mind.