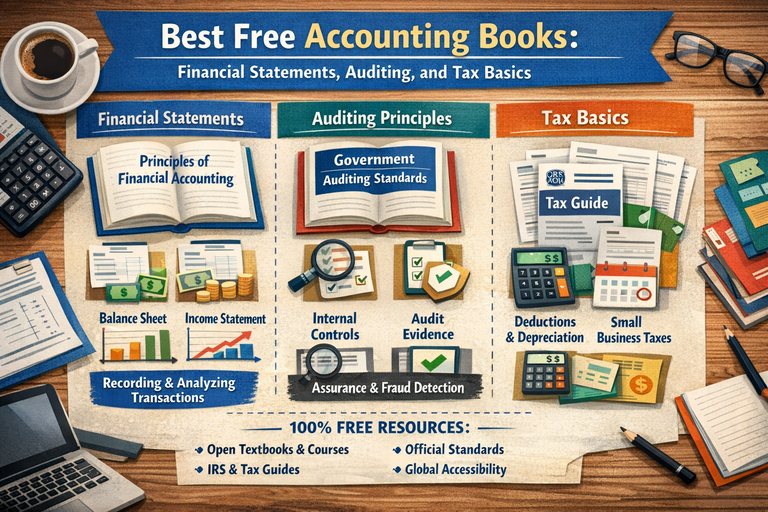

Best Free Accounting Books: Financial Statements, Auditing, and Tax Basics

Accounting is the language of business. Whether you’re a student preparing for exams, a founder trying to understand your numbers, or a small business owner aiming to keep clean books, the fastest way to build confidence is to learn from high-quality, legally free accounting books and official guidance.

This guide curates reputable, no-cost books and book-length resources across three essential accounting pillars:

-

Financial statements – how transactions are recorded, adjusted, and presented

-

Basic auditing principles – how financial information is verified and controlled

-

Tax basics – how taxable income works and how common filings are handled, especially for small businesses

What “free” means here: Every resource listed is typically available at no cost from official publishers, open-textbook libraries, standards bodies, universities, or government websites. Some may require free registration, and availability can change over time.

What to Look for in a Free Accounting Book

Before downloading anything, check for these quality signals:

-

Clear scope: Financial accounting vs managerial accounting vs auditing vs tax

-

Exercises and solutions: Accounting is learned by doing journal entries, adjustments, statements

-

Up-to-date framing: Especially important for tax rules and auditing standards

-

Jurisdiction alignment:

-

Financial reporting: U.S. GAAP vs IFRS

-

Tax: country-specific (IRS, HMRC, CRA, ATO, etc.)

-

1) Best Free Books for Financial Statements

These resources are ideal for learning how transactions flow into the Income Statement, Balance Sheet, and Cash Flow Statement, and how to interpret them.

A. OpenStax — Principles of Financial Accounting

Level: Beginner to early intermediate

Best for: Students, entrepreneurs, career switchers

Why it’s excellent: A full modern textbook with strong explanations, examples, quizzes, and end-of-chapter problems. It walks you through the entire accounting cycle from recording transactions to preparing and analyzing financial statements.

Where: OpenStax (free online and downloadable formats)

Key topics you’ll learn

-

Accounting equation and double-entry bookkeeping

-

Revenue and expense recognition basics

-

Adjusting entries and the closing process

-

Preparing and reading core financial statements

-

Receivables, inventory, fixed assets, liabilities, and equity

B. OpenStax — Principles of Managerial Accounting (Highly Complementary)

Level: Beginner to intermediate

Best for: Business owners and managers

Why it’s valuable: Financial statements tell you what happened. Managerial accounting helps you decide what to do next pricing, budgeting, and cost control.

Where: OpenStax

Key topics

-

Cost behavior and cost–volume–profit (CVP) analysis

-

Budgeting and variance analysis

-

Job vs process costing

-

Decision tools (make-or-buy, pricing, product mix)

C. MIT OpenCourseWare (OCW) — Financial Accounting Course Materials

Level: Beginner to intermediate (varies by course)

Best for: Learners who want a classroom-style experience

Why it’s useful: Lecture notes, assignments, and exams help you practice under realistic academic conditions.

Where: MIT OpenCourseWare (free)

How to use it effectively

-

Use OpenStax as your main textbook

-

Use OCW assignments as exam-style practice after each topic

D. Open Textbook Library - Curated Accounting Textbooks

Level: Varies (introductory to advanced)

Best for: Finding alternatives if OpenStax doesn’t match your course

Why it’s good: A reputable, university-curated catalog of peer-reviewed open textbooks.

Where: Open Textbook Library (search financial accounting or principles of accounting)

Tip: Prioritize books with worked examples or solution manuals this is where most self-learners make real progress.

E. IFRS Foundation- IFRS for SMEs (and Training Modules)

Level: Intermediate

Best for: Learners in IFRS-oriented countries and small businesses

Why it matters: A simplified, authoritative standard designed for smaller entities, directly from the source.

Where: IFRS Foundation website (many resources are free)

Suggested Learning Path for Financial Statements (2–4 Weeks)

-

Week 1: Accounting equation, debits/credits, journal entries

-

Week 2: Adjusting entries, accruals/deferrals, trial balance

-

Week 3: Income Statement, Balance Sheet, Cash Flow Statement

-

Week 4: Inventory, depreciation, liabilities, and basic ratio analysis

2) Best Free Resources for Basic Auditing Principles

Auditing focuses on reasonable assurance determining whether financial statements are free from material misstatement. Even if you never become an auditor, auditing knowledge sharpens your understanding of internal controls, fraud prevention, and reliable reporting.

Because most commercial audit textbooks are paid, the strongest free learning comes from official standards and public-sector guidance.

A. U.S. GAO — Government Auditing Standards (“Yellow Book”)

Level: Introductory to intermediate

Best for: Core audit concepts and ethics

Why it’s excellent: Clear, practical, and authoritative. It teaches independence, evidence, professional judgment, quality control, and reporting skills transferable to any audit context.

Where: U.S. Government Accountability Office (free PDF)

Core concepts

-

Independence and ethical principles

-

Audit planning and risk assessment

-

Evidence and documentation

-

Audit reports and quality assurance

B. PCAOB — Auditing Standards (U.S. Public Company Focus)

Level: Intermediate

Best for: Learning audit structure and internal control concepts

Why it’s useful: The rulebook for audits of U.S.-listed companies and a strong reference for audit documentation and ICFR basics.

Where: PCAOB website (free)

C. International Standards on Auditing (ISAs) — IAASB / IFAC

Level: Intermediate

Best for: Learners outside the U.S. or anyone wanting globally recognized audit language

Why it’s valuable: ISAs explain audit objectives systematically risk assessment, materiality, responses, and reporting.

Where: IAASB / IFAC (often free with registration)

D. Saylor Academy- Auditing Course Materials

Level: Beginner to intermediate

Best for: Guided self-study with structure

Why it’s good: Combines readings, learning outcomes, and assessments into a coherent, free course.

Where: Saylor Academy

A Practical Way to Learn Auditing (Without a Paid Textbook)

Try this mini-project approach:

-

Choose a simple set of financial statements

-

Identify key assertions: existence, completeness, valuation, cutoff, presentation

-

Draft a basic audit plan:

-

What could go wrong (risks)?

-

What documents would support the numbers (evidence)?

-

What controls reduce the risk?

-

-

Write a one-page “audit findings” memo

This builds real-world auditing intuition fast.

3) Best Free Books and Resources for Tax Basics

Tax rules change frequently and vary by country, so the best “free books” are often official government publications essentially short textbooks written for real filing situations.

A. IRS Publications and Instructions (United States)

Level: Beginner to intermediate

Best for: Individuals, freelancers, and small businesses

Why they’re excellent: Official, detailed, and practical, with definitions, examples, and limitations clearly explained.

Where: IRS.gov (Publications & Forms)

Commonly useful topics

-

Starting and running a small business

-

Deductible business expenses

-

Depreciation and capitalization

-

Estimated taxes and payroll obligations

-

Home office, travel, and vehicle documentation

B. IRS Small Business and Self-Employed Tax Center

Level: Beginner

Best for: Understanding obligations by business type

Why it’s helpful: Connects your business structure (sole prop, partnership, S-corp, C-corp) to the correct forms and deadlines.

Where: IRS.gov

C. Other Countries: Official Tax Authority Guides

If you’re outside the U.S., rely on your national tax authority’s free guides:

-

UK: HMRC manuals (self-assessment, VAT, payroll)

-

Canada: CRA small business guides (GST/HST, expenses, payroll)

-

Australia: ATO guidance (BAS, GST, deductions)

Rule of thumb: Trust official guides and manuals over blog posts especially for deductions and compliance.

A Simple Path to Learn Tax Basics (1–3 Weeks)

-

Understand taxable income vs accounting profit

-

Learn common deduction categories and documentation rules

-

Study depreciation and repairs vs improvements

-

Learn filing obligations and deadlines for your business type

-

Practice with a sample return or mock income/expense worksheet

Recommended Free “Starter Kit” (All Three Areas)

If you want a single, cohesive plan using only free resources:

-

Financial accounting: OpenStax Principles of Financial Accounting

-

Decision support: OpenStax Principles of Managerial Accounting

-

Auditing mindset: GAO Yellow Book (+ PCAOB or ISAs for structure)

-

Tax basics: Official tax authority publications (IRS, HMRC, CRA, ATO)

Tips for Students and Small Business Owners

For Students

-

Always complete end-of-chapter problems

-

Build a glossary (accruals, deferrals, materiality, internal control, depreciation)

-

Connect the dots: entries → statements → audit assertions → tax reporting

For Small Business Owners

Focus on:

-

Clean transaction categorization

-

Monthly reconciliations

-

Strong documentation habits (receipts, invoices, mileage logs)

-

Understanding your cash flow statement, not just profit

Use basic auditing ideas to design simple controls approval workflows, separation of duties, and regular bank reconciliations.

Final Thought

You don’t need expensive textbooks to master accounting fundamentals. With the right free books, official standards, and structured practice, you can build real, practical accounting skills whether your goal is passing exams, running a business, or simply understanding the numbers behind every decision