Top 10 Personal Finance Books for Beginners in 2024

Navigating the world of personal finance can be daunting, especially if you’re just starting out. With an overwhelming amount of information out there, it’s crucial to find resources that break down complex financial concepts into digestible and actionable advice. Whether you want to get out of debt, start saving, or invest for the future, the right book can set you on the path to financial success. Here are the top 10 personal finance books for beginners in 2024:

1. "I Will Teach You to Be Rich" by Ramit Sethi

Ramit Sethi’s book is a must-read for anyone looking to gain control over their finances. With its no-nonsense approach, Sethi provides a six-week program to help readers automate their finances, save for the future, and spend money guilt-free on the things they love. Updated for 2024, the book includes insights on managing money in the digital age and navigating financial decisions post-pandemic.

2. "The Simple Path to Wealth" by JL Collins

JL Collins’ straightforward and engaging writing style makes this book a favorite among beginners. Originally derived from a series of blog posts written for his daughter, Collins covers everything from the importance of financial independence to investing in index funds. The 2024 edition offers new chapters on the evolving investment landscape and updated advice on tax-advantaged accounts.

3. "Rich Dad Poor Dad" by Robert T. Kiyosaki

A classic in the personal finance world, “Rich Dad Poor Dad” contrasts the financial philosophies of Kiyosaki’s two “dads” – his real father (poor dad) and his best friend’s father (rich dad). This book emphasizes the importance of financial education, investing in assets, and understanding the difference between liabilities and assets. Its timeless principles make it a great starting point for beginners.

4. "You Are a Badass at Making Money" by Jen Sincero

Jen Sincero’s book blends motivational coaching with practical financial advice. With her signature wit and humor, Sincero tackles the mental barriers that often hold people back from financial success. This book is perfect for those who need a mindset shift as much as they need practical tips on earning and managing money.

5. "Broke Millennial: Stop Scraping By and Get Your Financial Life Together" by Erin Lowry

Erin Lowry’s “Broke Millennial” is tailored for millennials who feel overwhelmed by their finances. Written in an engaging and relatable style, Lowry covers everything from student loans and credit scores to investing and budgeting. The updated 2024 edition includes new strategies for dealing with gig economy income and the latest financial tools and apps.

6. "Financial Freedom: A Proven Path to All the Money You Will Ever Need" by Grant Sabatier

Grant Sabatier’s journey from broke to millionaire in five years serves as the foundation for this comprehensive guide. “Financial Freedom” provides actionable steps to achieve financial independence quickly, including saving, investing, and increasing income. Sabatier’s story is both inspiring and instructive, making it a valuable resource for beginners.

7. "Your Money or Your Life" by Vicki Robin and Joe Dominguez

This transformative book encourages readers to rethink their relationship with money and life. Robin and Dominguez outline a nine-step program that helps readers track their expenses, reduce spending, and achieve financial independence. The 2024 edition includes updated advice on digital minimalism and sustainable living.

8. "The Total Money Makeover" by Dave Ramsey

Dave Ramsey’s “The Total Money Makeover” offers a clear, step-by-step plan to get out of debt and build wealth. Ramsey’s “baby steps” approach simplifies the process of managing money, making it accessible for beginners. Known for his straightforward and sometimes tough-love style, Ramsey’s book is a great motivator for those ready to take control of their financial future.

9. "The Psychology of Money" by Morgan Housel

Morgan Housel’s “The Psychology of Money” explores the often-overlooked emotional and psychological aspects of personal finance. Through a series of short stories, Housel demonstrates how our behavior and mindset impact financial success. This book provides valuable insights into why we make financial decisions and how to make better ones.

10. "Atomic Habits" by James Clear

While not exclusively a personal finance book, “Atomic Habits” is an essential read for anyone looking to build better financial habits. James Clear’s practical advice on habit formation can be applied to all areas of life, including money management. By understanding how to create and maintain good habits, readers can set themselves up for long-term financial success.

Why These Books?

These books were chosen based on their accessibility, practical advice, and relevance to today’s financial climate. They cover a range of topics, from basic budgeting and saving to investing and financial independence, ensuring there’s something for everyone. Moreover, they emphasize the importance of mindset and behavior in achieving financial success.

Getting Started with Personal Finance

- Set Clear Goals: Determine what you want to achieve with your finances. This could be paying off debt, saving for a home, or building an emergency fund.

- Create a Budget: Track your income and expenses to see where your money is going. This will help you identify areas where you can cut back and save.

- Build an Emergency Fund: Aim to save three to six months’ worth of living expenses. This will provide a financial cushion in case of unexpected expenses or job loss.

- Pay Off Debt: Focus on paying off high-interest debt first, such as credit card debt. Consider using the debt snowball or debt avalanche method to stay motivated.

- Start Investing: Once you have an emergency fund and have paid off high-interest debt, start investing for the future. Consider low-cost index funds as a beginner-friendly option.

- Educate Yourself: Continuously learn about personal finance through books, podcasts, and online resources. The more you know, the better financial decisions you can make.

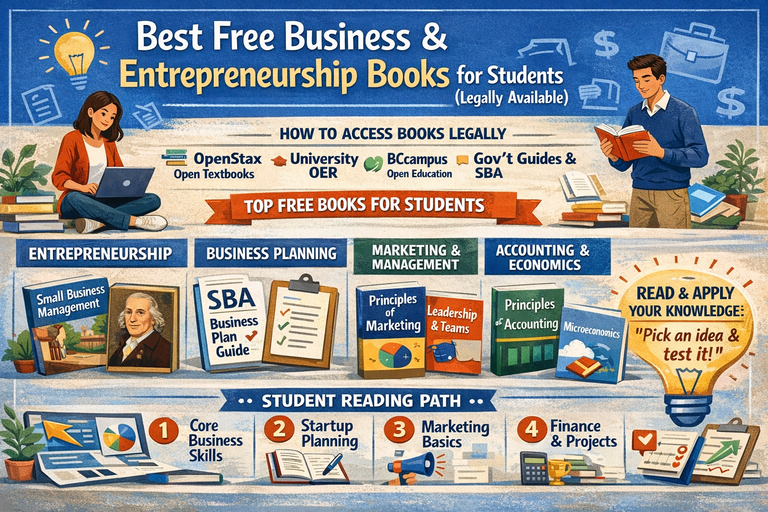

Must-Read Financial Books for Entrepreneurs

Financial Books for Kids and Teens: Instilling Financial Literacy from a Young Age

Conclusion

Starting your personal finance journey can feel overwhelming, but the right resources can make all the difference. These top 10 books offer practical advice, motivational insights, and actionable steps to help you take control of your finances in 2024. By setting clear goals, creating a budget, building an emergency fund, paying off debt, and investing for the future, you can achieve financial success and live a life of financial freedom. Happy reading!